17+ Lifetime mortgage

In practice a 30-year mortgages duration is closer to the five-year note but the market tends to use the 10-year bond as a benchmark. Americas 1 Rated Reverse Lender Celebrating 17 Years of Excellence.

Chris Johnson Senior Account Executive Velocity Mortgage Capital Linkedin

The Best 10-Year Mortgage Rates of 2022.

. This calculator figures monthly mortgage payments based on the principal borrowed the length of the loan and the annual interest rate. A new Lifetime movie starring Thora Birch details the relationship between Gabby Petito and Brian Laundrie and the vloggers death. So if youre borrowing 300000 for example one point would cost you 3000.

With so many factors to consider and so many online sources. MMS Mortgage Services Ltd. Borrowers are still responsible for property taxes or homeowners insuranceReverse mortgages allow older.

If you have built up a lot of equity in your primary residence maximizing your retirement portfolio may be difficult with the payout limits of government-insured reverse. Review current mortgage rates tools and articles to help choose the best option. Chase offers mortgage rates updated daily Mon-Fri with various loan types.

A reverse mortgage is a mortgage loan usually secured by a residential property that enables the borrower to access the unencumbered value of the property. For more info on why your loan-to-value band is important and how much you can save by putting down a bigger deposit see our How much can I borrow. Tappable equity drops after largest home price drop since 2011 Annual home price growth shifted from deceleration to decline in July as the median home price dropped 77 from June the largest single-month decline since January 2011.

A lifetime mortgage is a loan secured against your home. The AAG Advantage Jumbo Reverse Mortgage. For example youd normally get a much better interest rate if you applied for an 80 mortgage with a 20 deposit than if you applied for an 81 mortgage with a 19 deposit.

Learn what a reverse mortgage is and how it works at the official blog of All Reverse Mortgage. 17 18 Jul 22. Each mortgage point can usually lower your rate by 125 to 25 basis points which equals 0125 to 025.

You may save more with a conventional loan that does not require lifetime MIP charges. No repayments are required until you die or move out of your home. Interest rates can be high.

8 2022 at 626 am. Professional mortgage services include remortgages estate planning critical illness cover life insurance pension reviews income protection more. 3YR Adjustable Rate Mortgage Calculator.

When taking out a mortgage loan you might be interested in knowing how much money you are actually paying for every thousand dollars you borrow. Lifetime Brands stock price target cut to 1100 from 1750 at DA. The AAG Advantage Jumbo Reverse Mortgage is AAGs privately offered reverse mortgage intended exclusively for owners of high-value homes.

The Milliman Mortgage Default Index MMDI which shows the latest monthly estimate of the lifetime default. You can take the money as a lump sum or as series of lump sums. He has devoted the past 17 years to reverse mortgages exclusively.

Retirement Interest Only Mortgage We now need to know your age and employment status Personal details Date of birth. This is typically set to 5 though in some cases it can be 6. 2022 USDA mortgage May 17 2022 Mortgage discount points explained January 13 2022 You Dont Need A 20 Downpayment To Buy A Home February 20 2019.

The current average lifetime mortgage rate is 425 compared to 275 for. A discount point also called a mortgage point is an upfront fee paid at closing to reduce your mortgage rate. Redmond Homeowners May Want to Refinance at.

The maximum amount the loan interest rate is able to increase throughout the duration of the loan. In 2008 the Northern Rock bank was nationalised by the British government due to financial problems caused by the subprime mortgage crisisIn 2010 the bank was split into two parts assets and banking to aid the eventual sale of the bank back to the private sectorOn 14 September 2007 the bank sought and received a liquidity support facility from the Bank of. The amount borrowed and the added interest isnt usually repaid until you die or.

If anything the above tables understate the current dominance of the 30 year FRM. The amount you pay for every thousand dollars will change depending upon the total amount of your loan. Has been operating as a full-service mortgage banker since 1987 providing and servicing loans throughout the country.

Courtesy of FBI SARASOTA COUNTY FL A new Lifetime movie. While equity release offers the chance to draw on the value of your home there are several drawbacks to consider. ET by Tomi Kilgore Activist Investing Shattuck Labs C4 Therapeutics See Activist Actions.

Child dependants 17 and under Back. Thank you so much Andy Cutting for your wonderful help through the process. Lifetime mortgages are available to homeowners aged 55 or over.

One point is equal to 1 of your loan amount. USDA eligibility and income limits. Buying a home can be the largest purchase many of us make in our lifetime and while exciting can also be stressful.

The following table highlights differences between conventional loans and FHA loans. We will make sure that your mortgage meets your needs at every stage including if there is a change in your plans later. The relationship we build with our clients is one that lasts a lifetime.

An adjustable rate will accrue interest at a much lower rate at todays rates but has a 5 lifetime cap and can go much higher if rates continue to. Theres no need to make monthly payments. See how much you can expect from a reverse mortgage loan by these 3 popular examples.

The loans are typically promoted to older homeowners and typically do not require monthly mortgage payments. Includes illustrations and loan comparisons. A lifetime mortgage is a type of equity release a loan secured against your home that allows you to release tax-free cash without needing to move out.

The loans do have annual and lifetime caps but the rates can increase over time. As a lifetime customer with Your Mortgage Decisions I am once again very happy with the service. 2022 All Reverse.

TALK TO OUR HUMAN EXPERTS TOLL FREE.

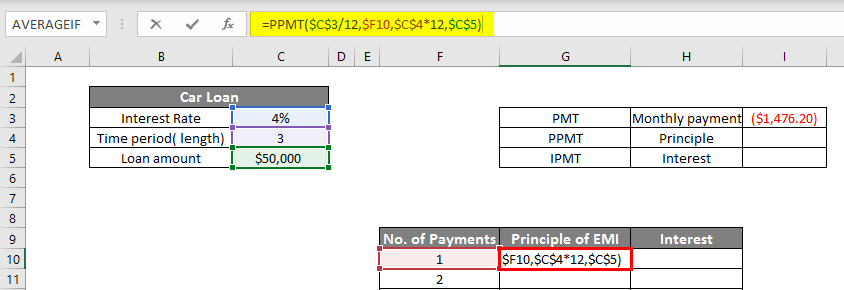

Excel Mortgage Calculator How To Calculate Loan Payments In Excel

Scott Goldman Cmb Vice President Cenlar Fsb Linkedin

![]()

Partners In Prevention Hope For The Day

Excel Mortgage Calculator How To Calculate Loan Payments In Excel

The Genesee Valley Penny Saver Batavia Edition 6 9 17 By Genesee Valley Publications Issuu

8 Strategies To Secure A Lower Mortgage Rate Tim Aragon

Cash Sheet Templates 15 Free Docs Xlsx Pdf Cash Flow Statement Cash Flow Statement Template

Excel Mortgage Calculator How To Calculate Loan Payments In Excel

Nancy Simon Mortage Loan Officer Diversified Capital Funding Nmls 284975 1850 Diversified Capital Funding Nmls 1850 Linkedin

Sec Filing Oportun Financial Corp

Excel Mortgage Calculator How To Calculate Loan Payments In Excel

Sec Filing Oportun Financial Corp

Greensky Inc 2018 8 K Current Report

Greensky Inc 2018 8 K Current Report

I M So Done With The Kids Don T Matter Attitudes At R Childfree Your Husband Taking In His 15yo Nephew So He Doesn T Go To Foster Care Means He Doesn T Care About You And

Excel Mortgage Calculator How To Calculate Loan Payments In Excel

Sec Filing Oportun Financial Corp